Advisory Services

What is Investment Advisory?

This service is designed for clients seeking close, tailored support for investing their capital. Pinvest conducts an assessment of objectives, investment horizon, and risk tolerance, and develops specific investment proposals based on each client’s individual needs. The service includes regular meetings, ongoing monitoring, site visits, and the delivery of technical reports with analysis and recommendations. It is an ideal option for high-net-worth clients who require continuous support in their investment decisions.

Advantages and Added Value

Personalized Investment Advisory

Investment advisory tailored to the specific goals and needs of each client, aligning strategies with their objectives and financial situation. We evaluate a variety of financial product alternatives in international markets and top-tier custodians, providing clients with confidence, security, and cost efficiency.

Compensation Model

A transparent, fee-only model, avoiding conflicts of interest by not receiving commissions for products sold through third parties.

Investment Monitoring

Continuous portfolio monitoring, with recommendations for adjustments to adapt to market conditions and changes in the client’s life.

Access to Experts

Experienced professionals with knowledge across various areas of finance and investments, providing specialized and high-quality advisory services.

Monitoring and Periodic Reports

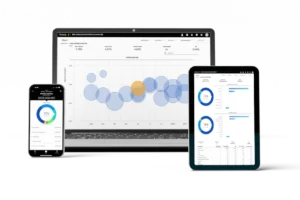

Pinvest clients have access to an analytical platform that transforms dispersed data into strategic insights, providing personalized financial reports that allow full control and in-depth analysis across multiple dimensions.

The objective of this service is to provide a comprehensive and consolidated view of assets through reports that facilitate effective decision-making. Report categories include:

- Portfolio summary

- Account statement with consolidation by entity, custodian, and ownership

- Detailed analysis by asset class

- Transaction report

- Cash flow projections and analysis

- Historical portfolio performance

- Risk analysis

- Geographic and sector breakdown by account and custodian

- Historical performance, calculation, and attribution

- Fees and commissions

Complete your information and we will contact you

Preguntas Frecuentes

The client only pays an advisory fee, which corresponds to the professional financial management and guidance service provided by Pinvest. There are no additional charges for access to the digital platform with consolidated financial information or for receiving reports, thereby ensuring transparency and clarity in the costs associated with the service.

Yes. Clients can access their reports through an advanced digital wealth management platform that centralizes financial information securely and efficiently. This platform allows consolidation of all types of assets—liquid investments, alternative assets, real estate, collections, and more—and generates personalized reports with a clear view of total wealth. To log in, clients use a username and password provided by their Pinvest advisor, enabling them to consult their reports and view the status of their portfolio at any time, with high security and ease of use.

Pinvest’s personalized advisory service is available to high-net-worth individual clients, family offices, and institutions seeking investment solutions aligned with their financial goals and risk tolerance. This service focuses on providing tailored financial strategies, comprehensive wealth analysis, and proactive portfolio management, combining the expertise of the Pinvest team with a transparent and fiduciary approach.

Top-tier custodians are highly recognized and reliable financial institutions that provide investment asset custody services and keep clients’ investments secure and separate from the advisory firm. These custodians have a strong reputation in the industry and comply with strict standards of security, transparency, and regulation. Pinvest works with top-tier custodians to ensure that clients’ assets are safely protected, with access to robust investment platforms and efficient asset management. Additionally, these custodians provide clear traceability and a high level of investor protection.