Investment Management

What is a Managed Model Portfolio?

It is a structured combination of assets—such as equities and bonds—selected and supervised by professionals. Each portfolio is designed to meet a specific investment objective: growth, capital preservation, or a combination of both.

Instead of managing their portfolio day-to-day, the investor relies on Pinvest for active management. After assessing the client’s profile, the most suitable portfolio is assigned, allowing investments with confidence and a long-term focus.

Model Portfolios

Conservative

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 15,330.82

Your profit could be: $ 5,330.82

Moderate

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 21,681.61

Your profit could be: $ 11,681.61

Balanced

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 30,354.51

Your profit could be: $ 20,354.51

Growth

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 41,913.17

Your profit could be: $ 31,913.17

Aggressive

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 55,472.92

Your profit could be: $ 45,472.92

Conservative

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 15,330.82

Your profit could be: $ 5,330.82

Moderate

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 21,681.61

Your profit could be: $ 11,681.61

Balanced

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 30,354.51

Your profit could be: $ 20,354.51

Growth

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 41,913.17

Your profit could be: $ 31,913.17

Aggressive

Annual Return

With an initial contribution of:

$ 10,000.00*Minimum Amount $5,000 USD

In 15 years:

Your capital could be worth: $ 55,472.92

Your profit could be: $ 45,472.92

Analysis based on historical data from the last 10 years, using the corresponding benchmark of each of the six instruments that make up the portfolios in their extended version, including their structural cash position.

Who is it for?

For individuals seeking long-term growth of their wealth, even if it involves seeing fluctuations along the way.

This service is ideal if:

- You want to invest your money for the long term.

- You prefer to delegate daily management to professionals.

- You understand that the market rises and falls unpredictably in the short term.

- You are seeking global diversification.

- You want a simple yet powerful strategy.

What Products Does Pinvest Use?

Pinvest builds its portfolios mainly using:

UCITS ETFs

Funds traded on stock exchanges that combine multiple investments within a single “package,” such as equities or bonds. They are regulated under European UCITS (Undertakings for Collective Investment in Transferable Securities) rules, which set strict standards for investor protection, diversification, and transparency.

If you are a U.S. resident, you cannot invest in UCITS ETFs, as they are not regulated by the SEC (Securities Exchange Commission).

Strong European Regulation: The fund must comply with strict European supervision, transparency, and control rules, providing greater investor protection.

Concentration Limits (maximum 10% per issuer): No more than 10% can be invested in a single entity, so that risk is not dependent on a single investment, although there is an exception for vehicles that aim to replicate stock market indices.

Clear Rules on Liquidity and Custody: The fund must maintain adequate liquidity to handle purchases, sales, or redemptions, and assets must be safeguarded by an independent custodian.

Accumulative Options: Enhance long-term growth thanks to the effect of compound interest.

Tax Efficiency: UCITS offer accumulative classes that reinvest dividends at the fund level instead of distributing them. This avoids withholding taxes on dividend payments. Additionally, UCITS funds are treated more favorably than U.S. ETFs for inheritance purposes, as they are not considered U.S. assets and are not subject to the tax rules applicable to U.S.-domiciled ETFs.

Pinvest LLC does not provide tax advice. Investors should consult their own tax advisors before making investment decisions.

How to Invest?

01

Risk Profile Assessment

The client completes a short questionnaire designed to determine their risk tolerance, goals, and investment horizon. After evaluating the responses, Pinvest recommends a model portfolio suitable for the client’s profile.

02

Portfolio Opening

The client opens the portfolio by providing the required information and uploading the requested documents. Once the process is complete, Pinvest will notify the client by email when the product is active and ready for investment.

03

Investment Management and Monitoring

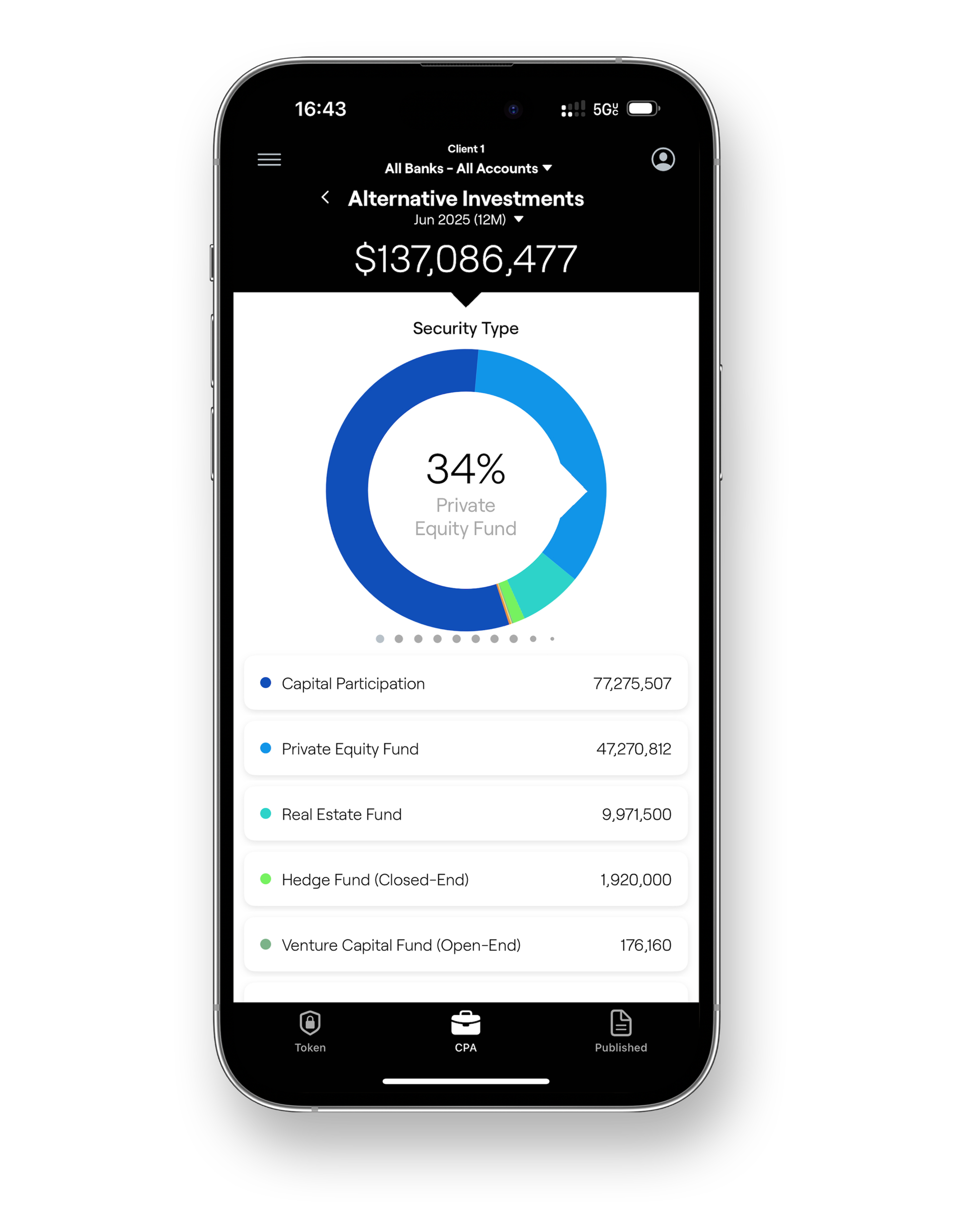

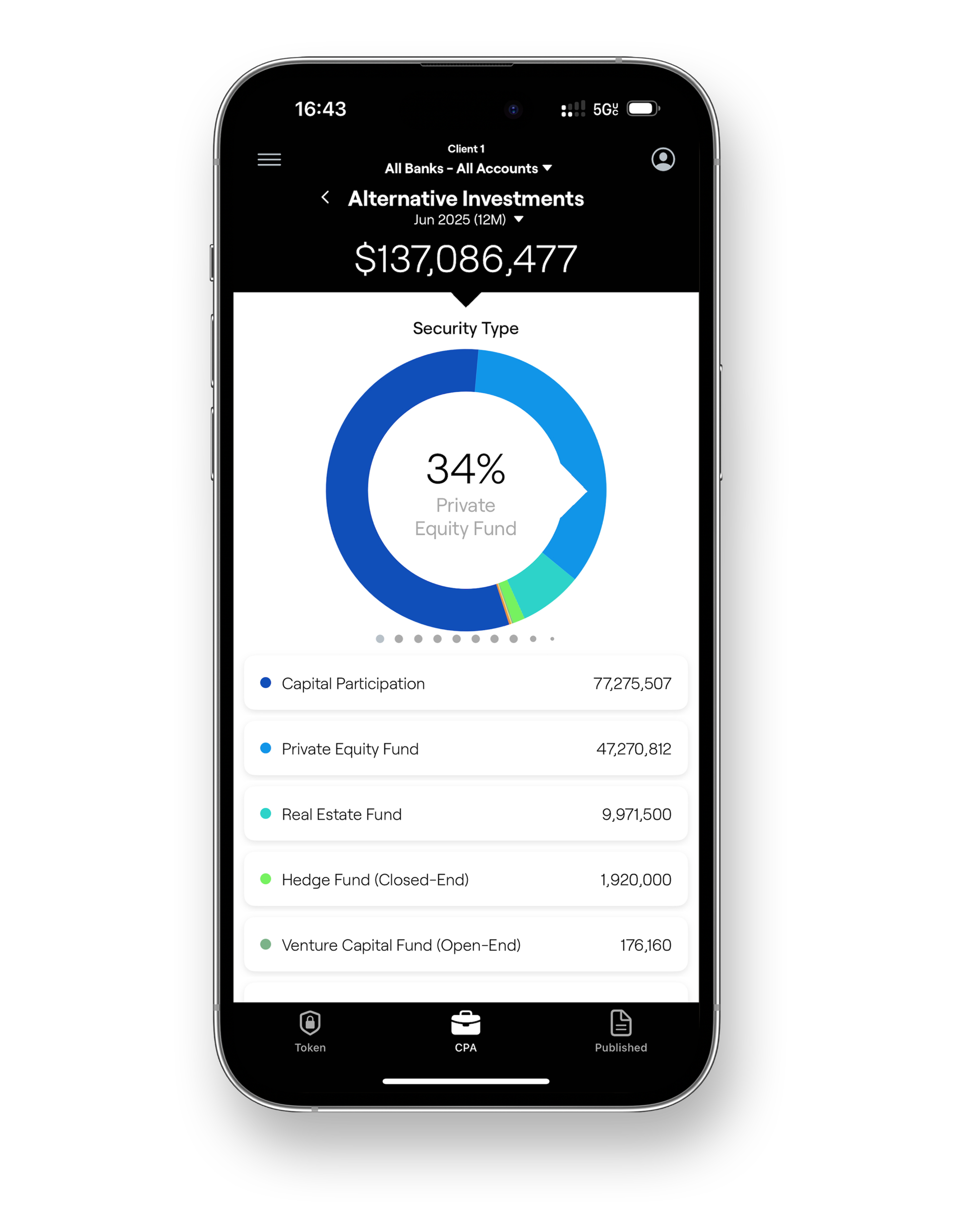

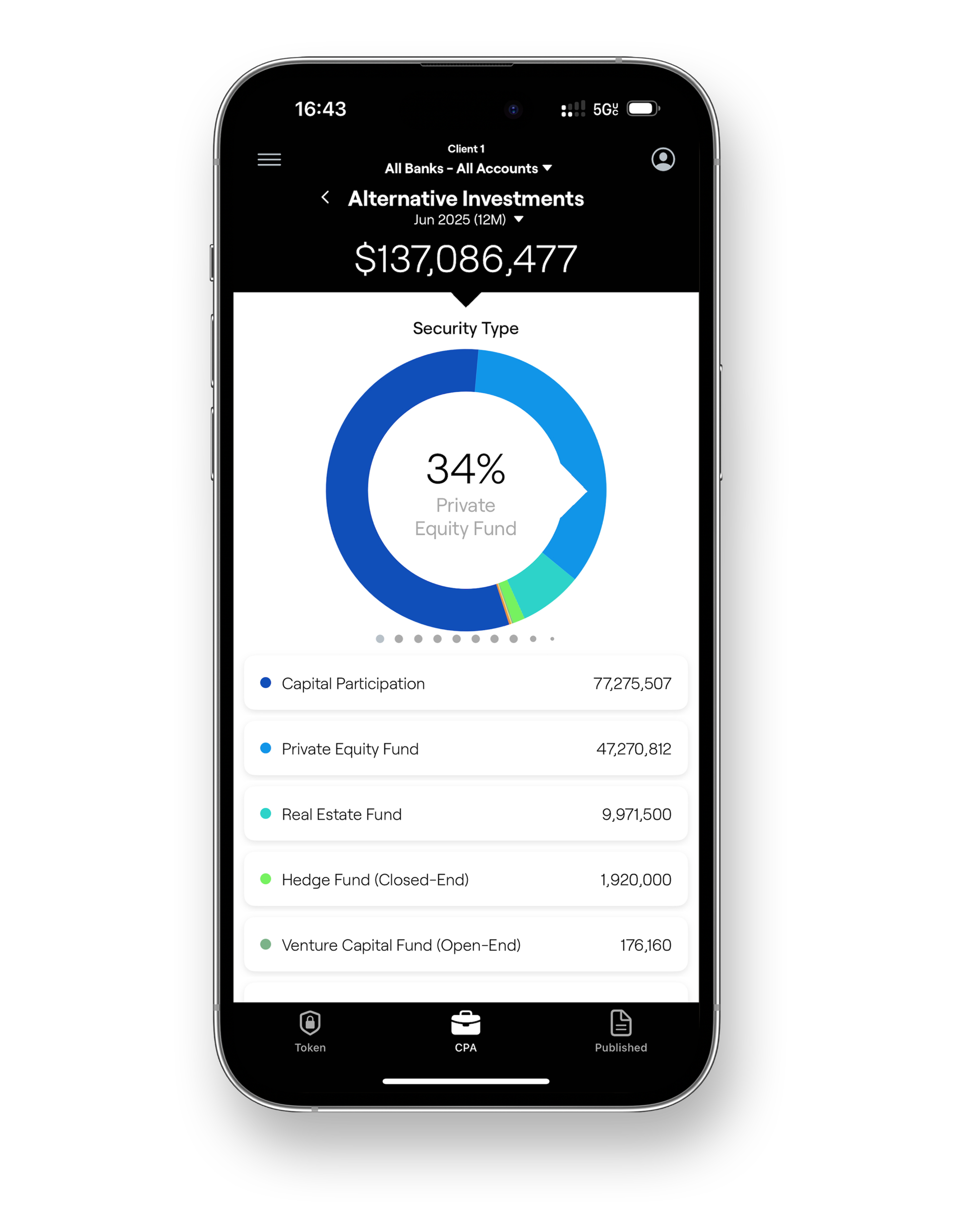

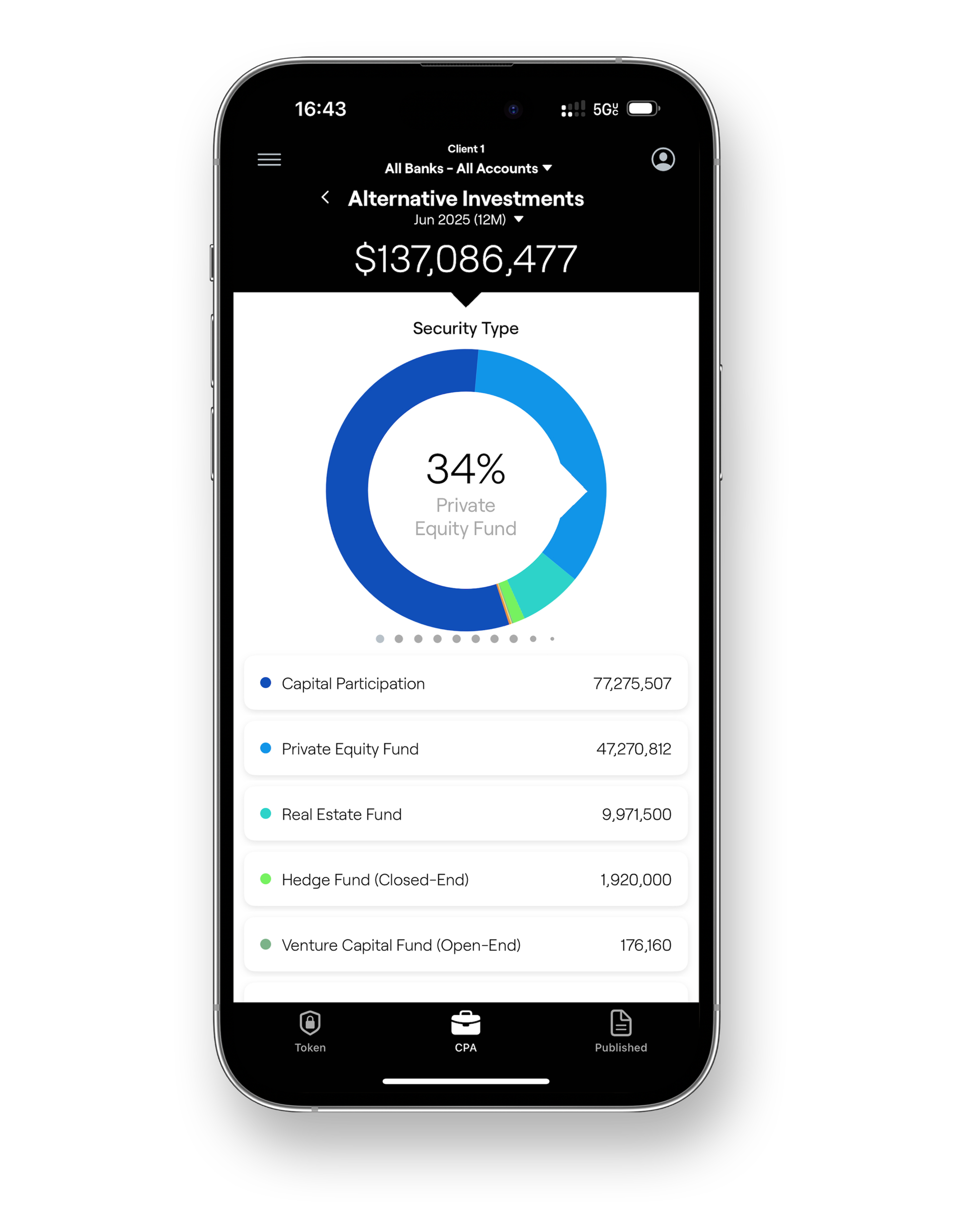

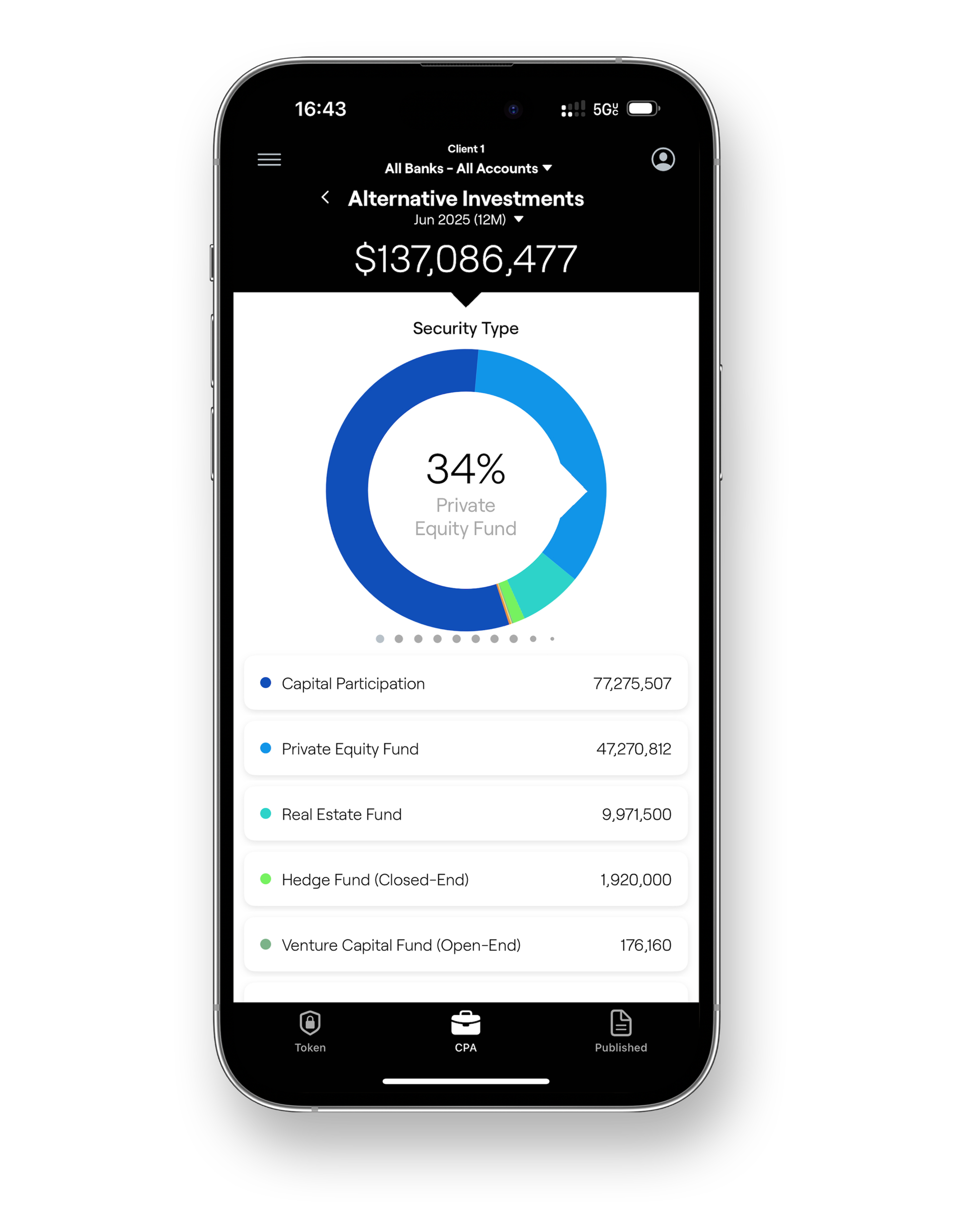

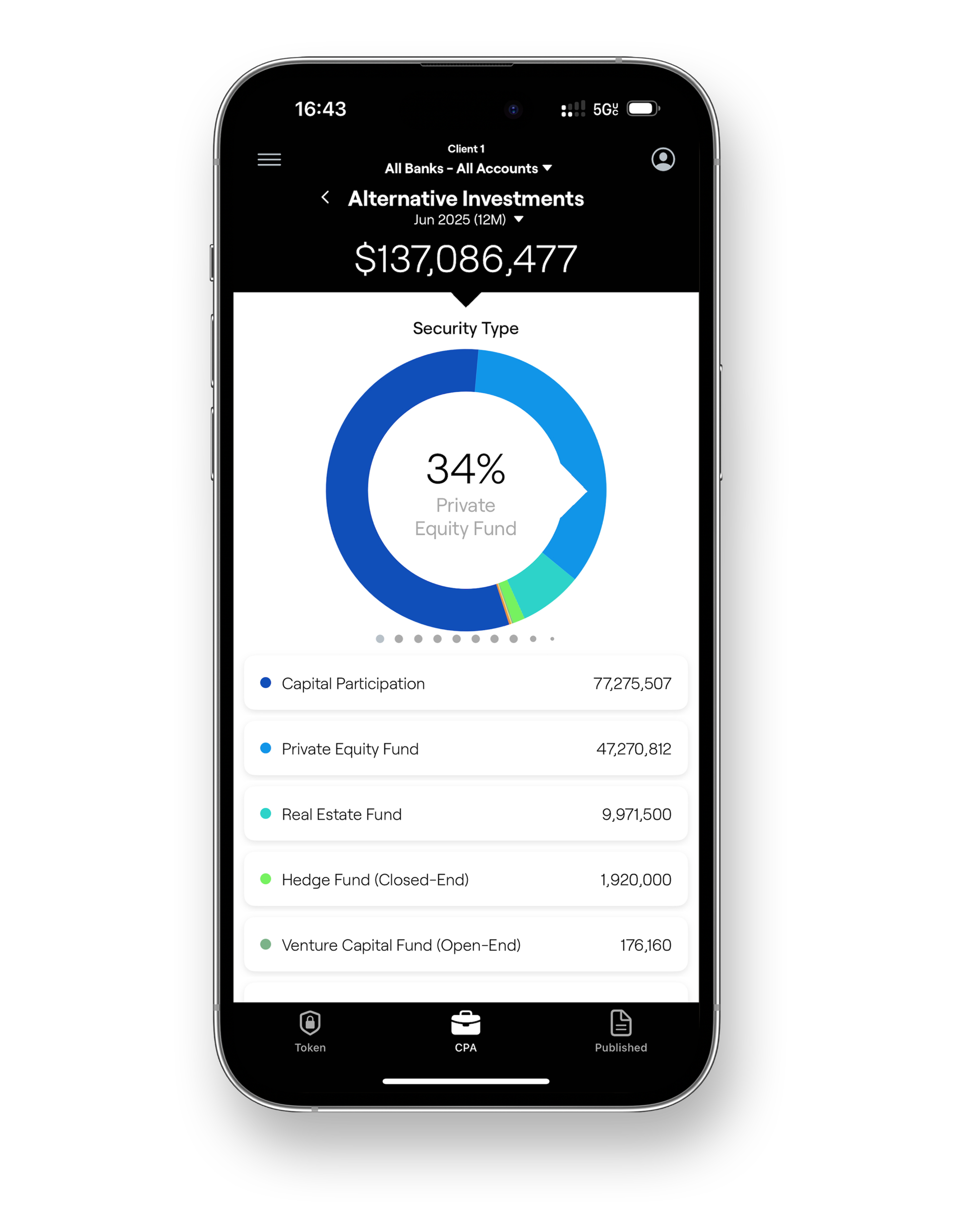

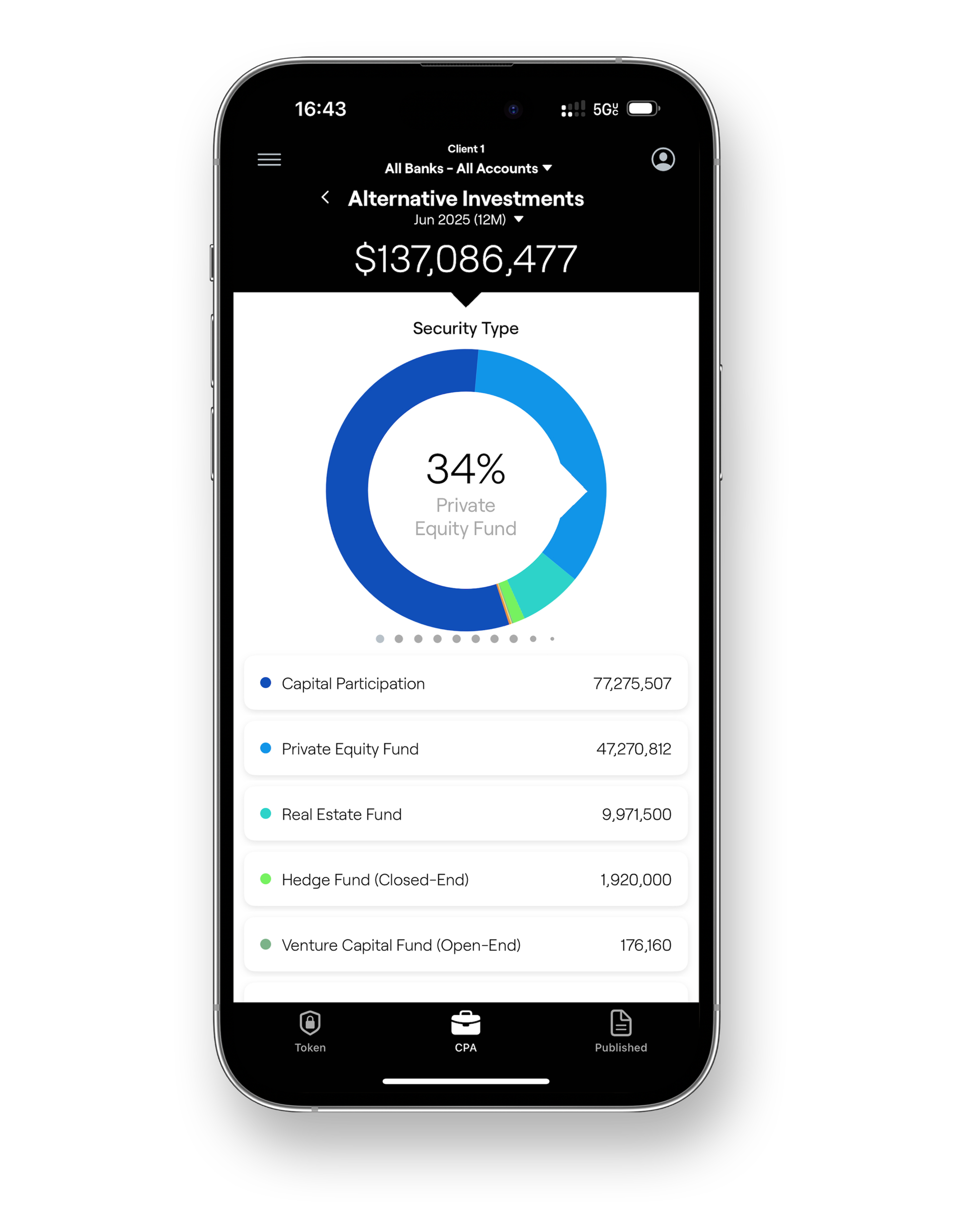

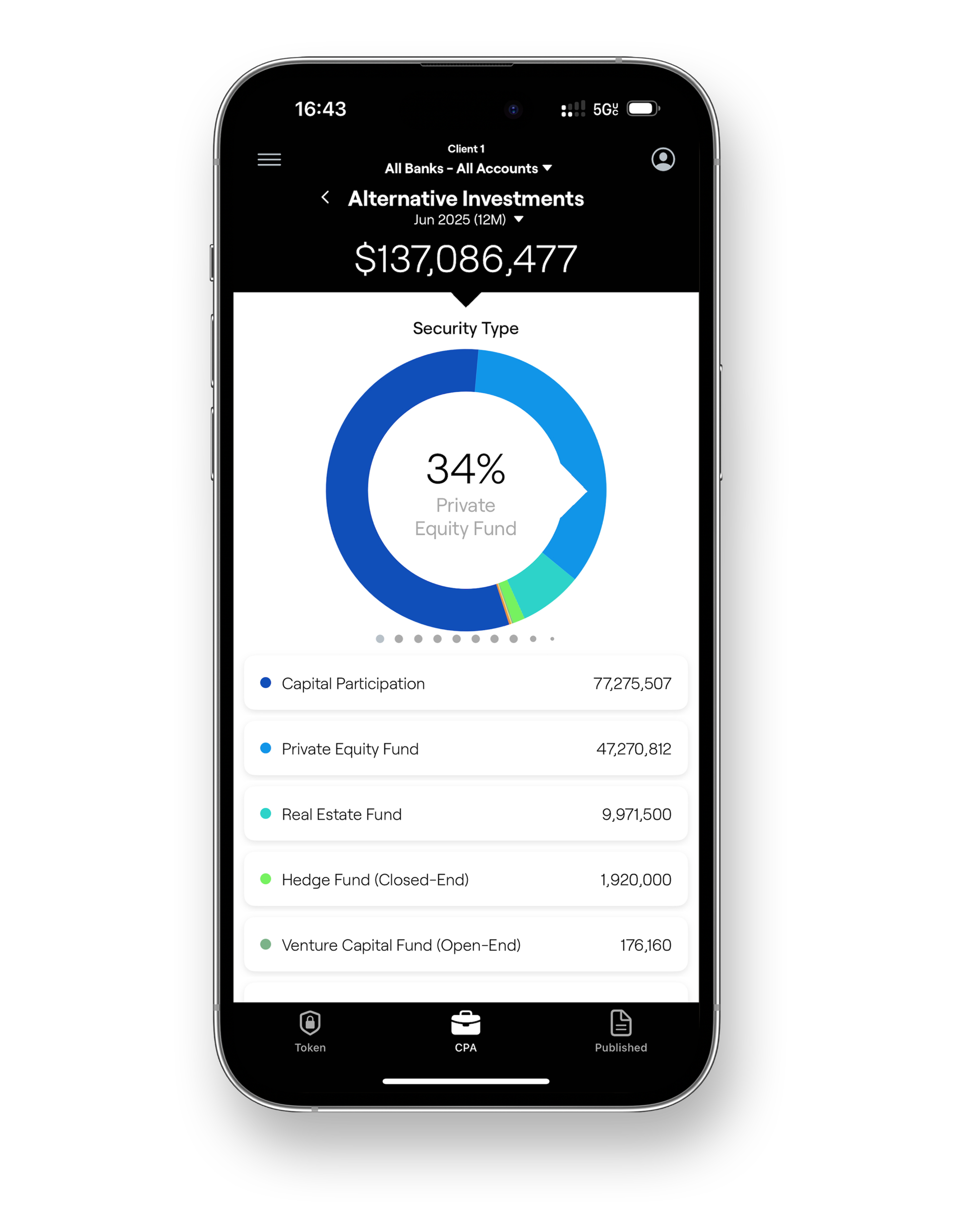

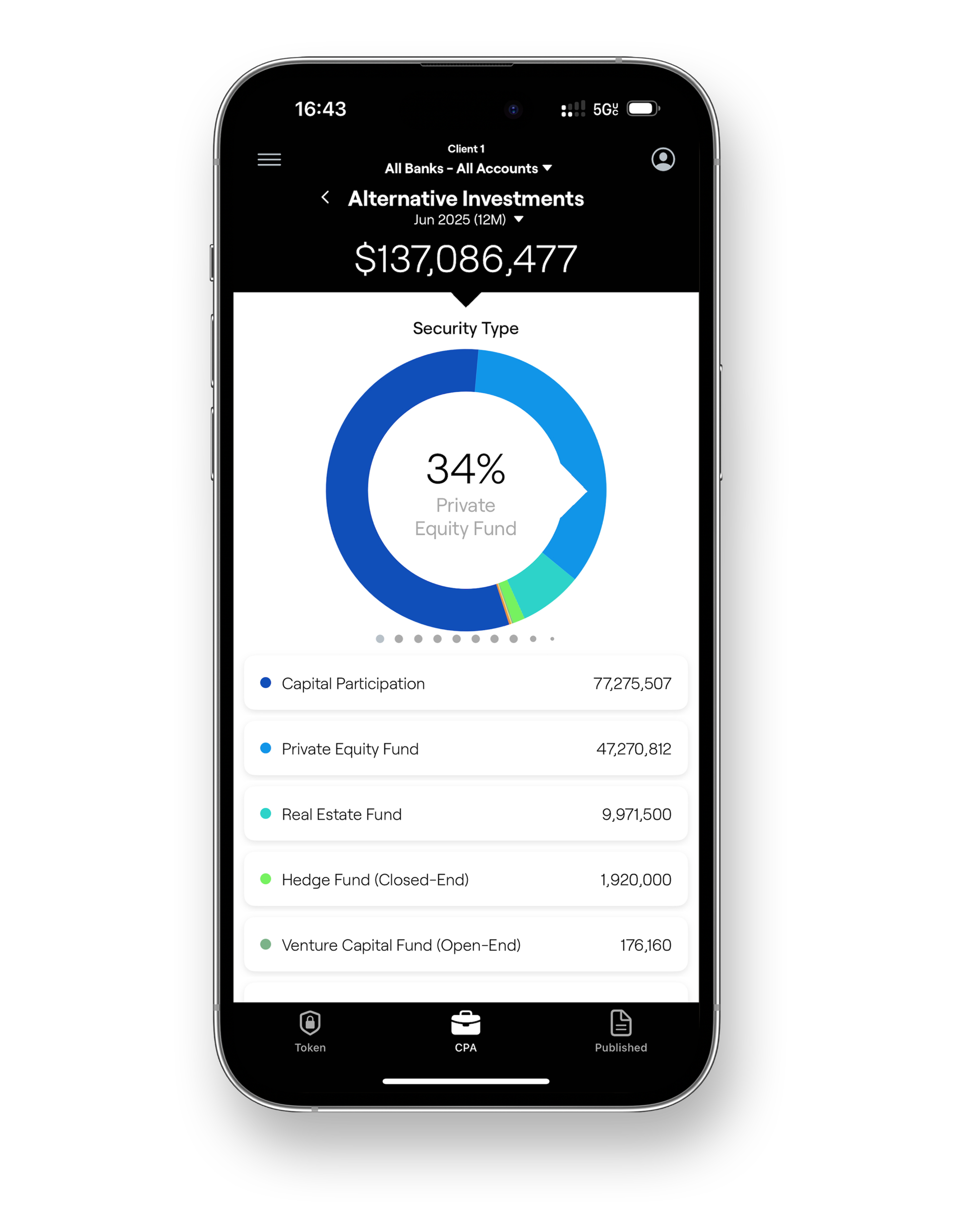

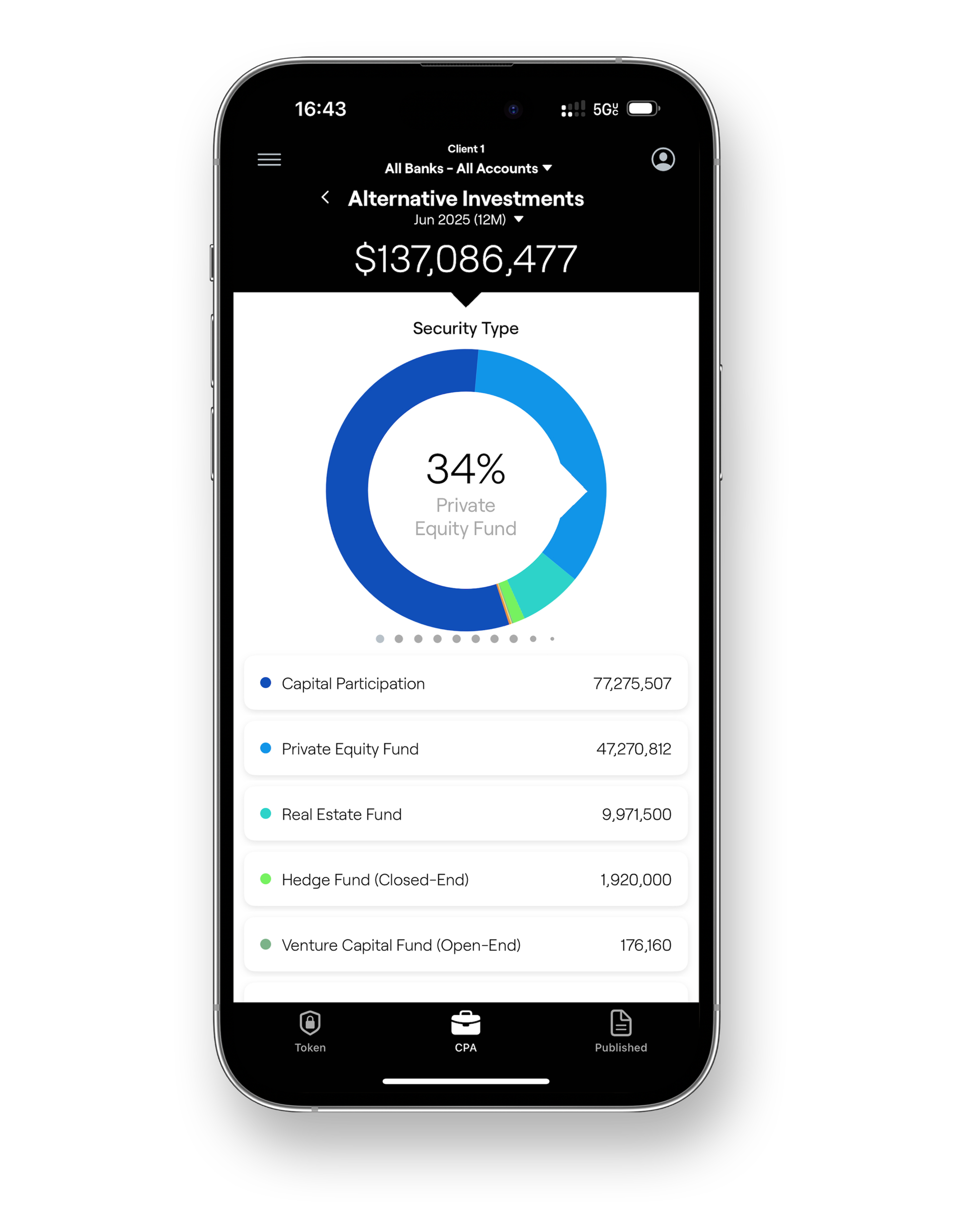

In the Pinvest app, available for download on the App Store and Google Play, the client can make their first investment, manage and monitor the portfolio, and make contributions or withdrawals as desired, with no penalties.

04

Continuous Professional Oversight

The Pinvest team handles portfolio rebalancing and monitoring, ensuring it remains aligned with the defined strategy and adapted to market conditions.

Model portfolios have a competitive cost

To keep costs low, efficient and low-cost investment vehicles are used. For models composed of UCITS ETFs, the portfolio management cost is 0.80% payable quarterly. Considering the additional costs of the instruments used, the total cost ranges between 0.89% and 0.92% depending on the model.

Example of fees:

A UCITS ETF portfolio with a constant value of $1,000 held for 5 years would have a total cost of $46, which represents $9.2 per year. Of this $9 per year, $8 corresponds to management fees and $1.2 to the cost of the UCITS ETFs.

Frequently Asked Questions

Yes. These portfolios are designed for individuals who do not have the time or the necessary knowledge to manage their investments directly. Based on the client’s personal information and financial goals, Pinvest assigns an investment profile and a model portfolio tailored to their needs.

A fixed-term deposit is an investment in which a person deposits their money in a bank for a specific period and receives a fixed interest rate in return. From the outset, the investor knows how much they will earn, and the principal does not fluctuate, making it an option focused on security and short-term objectives. However, its return depends directly on prevailing interest rates, which may rise or fall over time.

A portfolio, on the other hand, is an investment strategy that distributes capital across various stocks and bonds globally, following broad market indices. Its value may fluctuate, but it is designed for long-term wealth growth, with high diversification and without relying on a fixed rate.

The difference between the two lies in their approach: fixed-term deposits prioritize predictability and immediate stability, while portfolios aim for greater growth over time, accepting valuation fluctuations as a natural part of the investment process.

The process of opening a model portfolio takes between 15 and 20 minutes. After entering all the required information, the client will receive a confirmation email within 48 to 72 hours, indicating whether the portfolio has been successfully opened or if additional documentation is required to complete the process.

Pinvest offers globally diversified portfolios starting from USD 5,000, using low-cost UCITS ETFs, which allows access to an efficient and well-structured investment from the outset.

The Pinvest app allows the client to check and track their investment in a simple and secure way. From the app, the client can:

- View portfolio composition: check which assets make up the investment and the percentage each one represents.

- Review updated returns: track accumulated performance with information available until the previous day’s close.

- Confirm the portfolio model: view the model assigned and selected based on the investment profile the client has chosen.

Yes. Clients can withdraw their money, either partially or totally, at any time and without penalties. In the case of a partial withdrawal, the requirement is to maintain a minimum investment balance of USD $5,000 in the account.

Transfers have an operational cost: the first withdrawal of each month is free of charge, and additional withdrawals within the same month are subject to a fee of up to $10 per transaction.

This approach offers flexibility to the client, maintaining clarity and transparency in the associated costs.

The suggested time frame and estimates are developed using historical metrics based on reference indexes to generate illustrative scenarios. To learn about the sources, assumptions, scope, and limitations, please refer to the “Methodological Guide: Suggested Term and Investment Projections”.